Table Of Contents

American Depositary Receipts (ADR) Definition

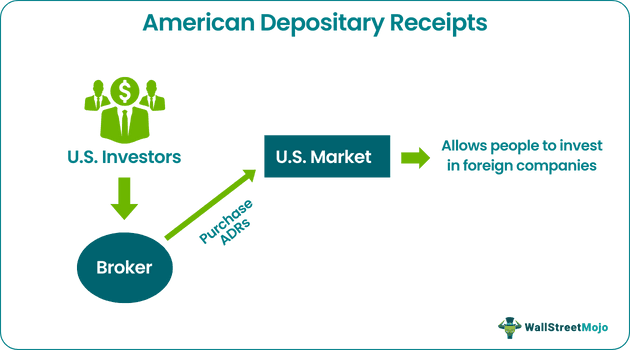

American Depositary Receipts (ADRs) are the stocks of foreign companies traded in the American markets. They are purchased by the investors in U.S. dollars during the regular trading hours in the U.S. market through the brokers, allowing America to invest in foreign companies. The American depository receipts list features multiple companies from different countries.

The ADR was first created in 1927 by J.P. Morgan, in which Americans were allowed to invest in Selfridges' shares, a British department store. According to the Securities and Exchange Commission (SEC), it is more convenient for investors to own ADRs in place of the foreign stock itself because they have protection and transparency in ADRs facilitated by the U.S. securities regulation.

Key Takeaways

- American Depositary Receipts (ADRs) represent shares of foreign companies traded in U.S. markets. They enable U.S. investors to purchase foreign company stocks using U.S. dollars during regular trading hours through brokers, providing Americans with access to invest in foreign companies.

- ADRs were first introduced in 1927 by J.P. Morgan, allowing American investors to invest in shares of Selfridges, a British department store.

- There are two basic types of ADRs: sponsored ADRs and unsponsored ADRs. Sponsored ADRs are established with the involvement and cooperation of the foreign company, while unsponsored ADRs are created without the direct participation of the foreign company.

American Depository Receipts Explained

The American Depositary Receipts allow the investors of the U.S. to trade in the shares of foreign companies quickly and conveniently. Furthermore, they also enable the investors to diversification of their portfolio as they can invest in companies not based in their home country America.

With the help of American Depositary Receipts, investors invest in companies located in emerging markets where they can maximize their profit out of the money invested. So, the American Depositary Receipts remove the restrictions on the Americans from investing only in their home country.

One of the primary advantages of ADRs is that they eliminate the need for U.S. investors to navigate different currencies and time zones, streamlining the investment process. ADRs come in various levels, each offering a distinct degree of access and reporting requirements.

Level I ADRs, for instance, are the most basic, permitting limited access to U.S. markets but with minimal reporting obligations. In contrast, Level II and III ADRs involve more stringent disclosure requirements, offering deeper engagement with U.S. investors.

Investors should be aware that while American depository receipts features provide a convenient means of investing in foreign companies, they also come with risks. Fluctuations in exchange rates, political developments in the home country of the foreign company, and differences in accounting standards are factors that can impact the performance of ADRs. As a senior content writer, it is crucial to highlight these nuances, allowing readers to make informed decisions when considering ADRs as part of their investment portfolio.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

Let us understand the different types of under the American depository receipts list through the explanation below.

Process

Understanding the process of ADRs provides investors with a straightforward mechanism to diversify their portfolios globally while navigating potential challenges inherent in international investing. Let us understand them through the discussion below.

- Issuance: A foreign company seeking to make its shares available to U.S. investors engages a U.S. depositary bank, which issues American Depositary Receipts (ADRs) against the underlying foreign shares.

- Custody: The U.S. depositary bank holds the foreign company's shares in custody, and in return, issues ADRs, which are traded on U.S. exchanges just like regular stocks.

- Levels of ADRs: ADRs come in different levels - Level I, Level II, and Level III. The level determines the degree of access and reporting requirements. Level I have fewer requirements but limited market access, while Level III involves more extensive reporting obligations and provides deeper access to U.S. markets.

- Trading: U.S. investors can buy and sell ADRs on U.S. exchanges during regular trading hours. This process allows investors to gain exposure to foreign companies without directly dealing with foreign exchanges and currencies.

- Currency Conversion: Dividends and capital gains from ADRs are typically paid out in U.S. dollars, sparing investors from the complexities of currency conversions.

- Risks: While ADRs offer accessibility to foreign markets, investors should be mindful of associated risks such as currency fluctuations, political developments, and differences in accounting standards between the U.S. and the foreign country.

Examples

Now that we understand the basics, process, and types of American depository receipts list, let us apply that knowledge to practical application through the examples below.

Example #1

Joe, an American investor wishes to invest in a well-known German automaker, XYZ Motors, listed on the Frankfurt Stock Exchange. Instead of navigating the complexities of trading directly on the German exchange, the investor opts for American Depositary Receipts (ADRs) for a more straightforward investment experience.

First, XYZ Motors engages with a U.S. depositary bank to issue ADRs against its shares. Then, the U.S. depositary bank issues XYZ Motors ADRs, each representing a certain number of XYZ Motors shares. These ADRs are then listed and traded on U.S. exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ.

Through a U.S. brokerage account, Joe purchases XYZ Motors ADRs on the U.S. exchange, just like any other domestic stock. He can now benefit from the performance of XYZ Motors without dealing with foreign currencies, time zone differences, or the need for a direct account on the Frankfurt Stock Exchange.

Example #2

Let us consider an example of the German company named Volkswagen shares which trades on the New York Stock Exchange. After compliance with various laws, it got listed on the American stock exchange. Now, investors in America can invest in Volkswagen through the stock exchange. However, if Volkswagen’s shares are listed in other countries’ stock markets apart from the U.S. market, termed the GDR.

American Depositary Receipts (ADR) Video Explanation

Advantages

Let us understand the advantages of considering the American depository receipts features through the points below.

- The issuer of the ADRs can access the capital available in the market in the U.S. and get a diversified base of shareholders (U.S. shareholders).

- ADR makes it easy for the issuer to go for merger and acquisition activities as they can use ADR as the currency for the acquisition.

- For the investor, ADRs are easy to use as they can buy and sell the shares of the other country’s company like their own company. Also, there is no need for a new broker or to open a foreign brokerage account as investors can use the same broker they normally deal with.

- Investor gets the opportunity to diversify their investment portfolio on a global scale.

- Everything is as per the U.S. working. The investors purchase ADRs in U.S. dollars; dividends are given in dollars, traded during the normal trading hours in the U.S., and are subject to settlement procedures as American stocks.

- It gives more accessibility of research and information to the investors, and investors can customize their portfolio according to their requirements like which countries they are interested in or which sector, etc.

Disadvantages

Despite the various advantages mentioned in the section above and throughout this article, there are a few factors that prove to be a disadvantage of American depository receipts list. Let us understand them through the explanation below.

- The unsponsored ADRs may not comply with the Securities and Exchange Commission (SEC).

- The investors might have limited companies for the selection as all the foreign companies are not available as ADRs.

- An investor needs enough capital investment; otherwise, creating a properly diversified portfolio will not be possible.

- The investor might face double taxation if the dividend is taxed differently, as ADR dividends received may be subject to the tax in the company's home country.

Important points

- Before investing in ADRs, one should consult a tax advisor and the financial advisor to understand the implications of the portfolio in which the person is planning to invest their capital as it involves international investing, one should initially go with a global mutual fund until one gets good knowledge about the same.

- There are several unique differences between American Depositary Receipts and foreign or traditional U.S. stocks, which one should consider before investing. Like taxes on the dividend may be charged differently. In the case of U.S. stocks, taxes charged will be in the U.S. only. Whereas, in the case of ADRs, dividends may also be subject to tax in the company's home country. In that case, to avoid double taxation, investors might have to apply for either a refund from a foreign country or apply for credit against their U.S. taxes.

Frequently Asked Questions (FAQs)

The key difference lies in the markets where they are primarily traded. GDRs are listed and traded on international stock exchanges outside the United States, while ADRs are listed and traded on U.S. stock exchanges.

No, American Depositary Receipts (ADRs) are not derivatives. Instead, ADRs are a type of equity security representing ownership in a foreign company. A U.S. bank creates them through depositary receipt issuance and allows U.S. investors to hold shares of foreign companies in their brokerage accounts and trade them in U.S. dollars.

ADRs and ADSs refer to the same concept: the representation of ownership in a foreign company held by U.S. investors through a U.S. bank. The term "ADR" is more commonly used in general, while "ADS" specifically refers to the individual shares of the foreign company represented by the ADR. In other words, ADR is the overall program or framework, whereas ADS is the actual share traded on the U.S. exchange.